1. Laser industry chain: Towards full autonomy and controllability, high-end products still need breakthroughs

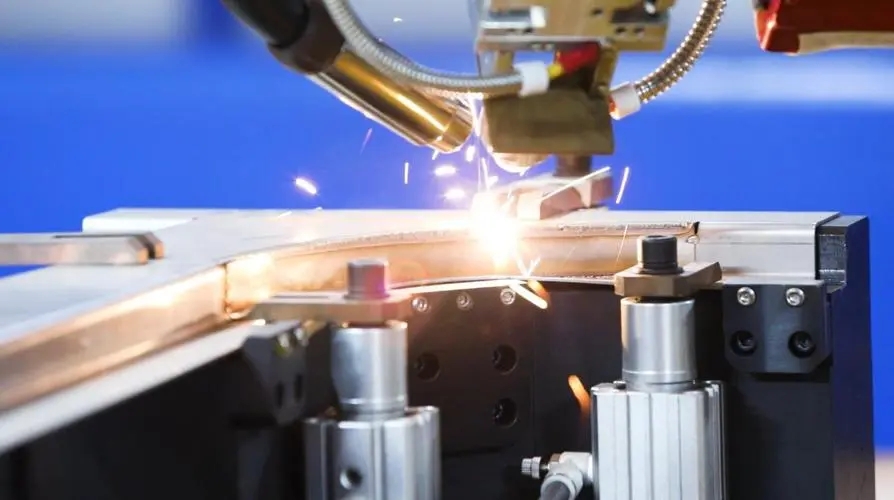

The upstream of the laser industry chain mainly includes optical materials, components and control systems, the midstream is mainly lasers, and the downstream is laser processing equipment. The terminal application fields cover traditional sheet metal processing, automobiles, medical care, semiconductors, PCBs, photovoltaic lithium batteries and other markets. According to the data of Qianzhan Industry Research Institute, the market size of China's laser industry in 2021 will be 205.5 billion yuan. Due to its high technical barriers and customer stickiness, the laser operation and control system is the link with the best competition pattern in the entire laser industry. Taking the laser cutting operation and control system as an example, in the field of medium and low power laser cutting control systems, the market share is about 90%, and the domestic substitution is basically completely realized. The localization rate of high-power laser cutting control system is only about 10%, which is an important part of domestic substitution. Lasers are devices that emit laser light, and account for the highest cost of laser equipment, up to 40%. In 2019, the domestic substitution rates of medium, low, and high-power lasers in my country were 61.2%, 99%, and 57.6%, respectively. In 2022, the overall localization rate of lasers in my country has reached 70%. China's laser processing equipment manufacturing industry has developed rapidly in the mid-to-low-end field in recent years, and the localization rate in the high-end market still needs to be improved.

2. The recovery signal of the manufacturing industry is showing, and the general laser has picked up in 2023Q1

In 2023Q1, the macroeconomic indicators are improving, and the recovery of the manufacturing industry is expected. In 2023Q1, the cumulative investment in fixed assets in the manufacturing industry (including automobiles, electrical machinery, and technology) increased by 7%/19.0%/43.1%/15% year-on-year respectively, and the electrical machinery and automobile industries maintained relatively high investment growth rates. In Q1 of 2023, corporate medium and long-term loans will increase by 53.93% year-on-year, entering the expansion range. Since 2023, the decline in China's metal cutting/forming machine tool production has narrowed year-on-year. Judging from the operating data of the laser industry, the general laser sector has recovered, and historical data has been reviewed. During the upward period of fixed investment in the manufacturing industry, the laser industry has shown a higher growth rate. Therefore, we are optimistic about the high growth resilience of the general laser industry after further demand recovery.

3. The export of laser processing machine tools reaches a new high, and domestic laser equipment replaces overseas

In March 2023, the export volume of domestic laser processing machine tools hit a record high, with a year-on-year increase of 37%. The inflection point of the export boom has reached, and global substitution may begin. The biggest advantage of domestic laser equipment is the price. After the localization of lasers and core components, the cost of laser equipment has dropped significantly, and fierce competition has also driven down prices. According to the data of Laser Manufacturing Network, the overall export of laser products in my country currently only accounts for about 10% of the laser output value, and there is still a lot of room for improvement. The core breakthrough is to improve the safety and stability of laser equipment in order to obtain permission to export to these countries .

Post time: May-25-2023